Financial intermediaries – Banks in India

Points to Ponder in This Article – Understand different types of banks which function in India, what are their primary goals, the aims with which they were setup, how they function & primary differences between them. Do not try to cram their definitions and minute differences in their administration, but what is important is their field area & population they target & with what motive.

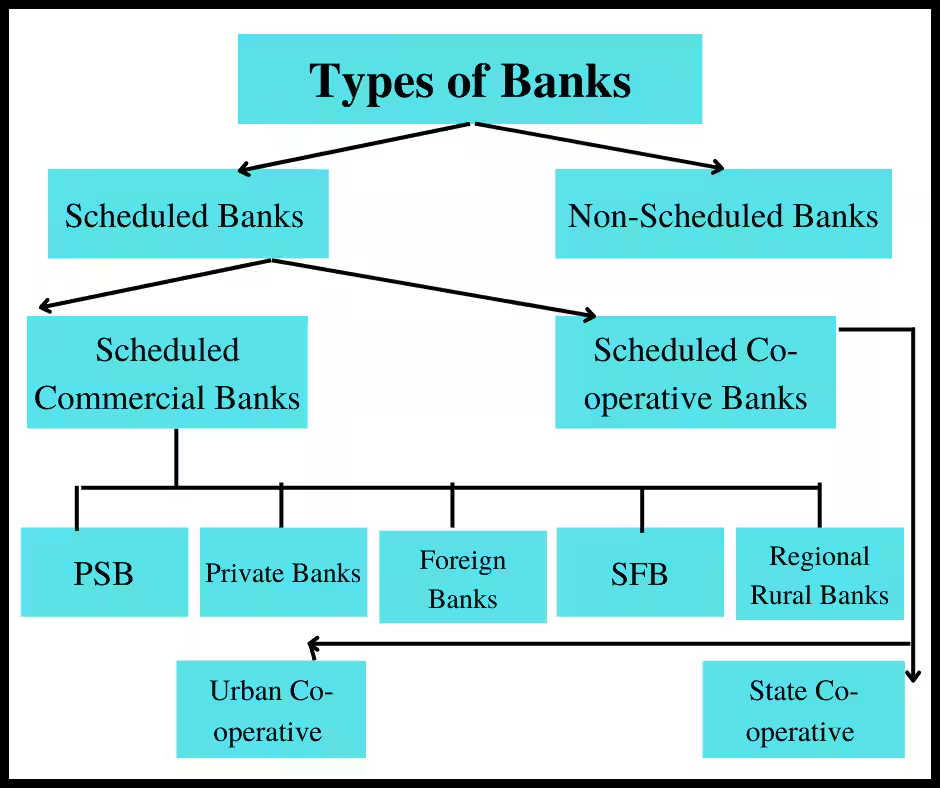

Scheduled Bank

Banks included in the 2nd Schedule to the Reserve Bank of India Act, 1934 are scheduled banks. Comprise of Scheduled Commercial Banks and Scheduled Cooperative Banks

Commercial Banks

- The main function of these types of banks is to give financial services to the entrepreneurs and businesses.

- Commercial Banks finance businessmen like providing them with debit cards, banks accounts, short term deposits, etc. with the money deposited by people in such banks

- Commercial banks lend money to these businessmen in the form of secured loans, unsecured loans, credit cards, overdrafts & mortgage loans.

- It got the tag of a nationalized bank in the year 1969 & hence the various policies regarding the loans, rates of interest, etc. are controlled by the RBI

- Further classifications of the commercial banks include private sector banks, public sector banks, regional banks and foreign banks.

- Public sector (21+ [1 SBI + 5 Associate banks]) + Private sector (23) + Foreign banks (41) + RRB

- FDI allowed in Indian banks > 49% automatic | 74% FIPB approval

- FDI allowed in foreign banks > 100% if wholly owned subsidiary

Public Sector Banks

- Owned and operated by the government, who has a major share in them.

- Major focus of these banks is to serve the people rather earn profits.

- Examples include State Bank of India, Punjab National Bank, Bank of Maharashtra, State bank of Patiala, Allahabad Bank, Canara Bank etc.

Private Sector Banks

- Owned and operated by private institutes; free to operate and are controlled by market forces.

- A greater share is held by private players, not by the government.

- For example, Axis Bank, Kotak Mahindra Bank, ICICI Bank, HDFC Bank etc.

Foreign Banks

- Foreign country banks having several branches in India.

- Some examples of these banks include HSBC, City Bank, Standard Chartered Bank etc.

Regional Rural Banks

- Came to birth on the recommendations of MM Narsimhan Committee

- Banks which can only operate in the areas specified by GOI

- They came into operation with the objective of providing credit to the agricultural and rural regions and were brought into effect in 1975

- RRBs are jointly owned by GoI, the concerned State Government and Sponsor Commercial Banks. The issued capital of a RRB is shared by the owners in the proportion of 50%, 15% and 35% respectively

- Financial strength and expertise of commercial banks

- Grassroot problem awareness of cooperative society

- Example : Prathama Bank located in Moradabad, UP sponsored bySyndicate Bank

Commercial Banks |

RRB |

|

| Area of operation | HUGE → Whole India (although mainly concentrated in urban areas and small towns) | SMALL → One or a few districts (rural) |

| Source of finance |

|

|

Regional Rural Banks (Amendment) Bill, 2013

- Removes 5 yr upper limit mandated for Sponsor Banks; allowing them to continue beyond this duration

- Increases the authorized capital of RRBs from 5 crore rupees to 500 crore rupees and the threshold limit from 25 lakh rupees to 1 crore rupees.

- Bill permits an RRB to raise capital from other sources in addition to Union government, concerned State government and Sponsor Bank.

- However, the combined shareholding of Union government & Sponsor Bank shall not be less than 51 %

- Provides for the appointment of Board of Directors by other entities also in addition to central & state gov., sponsored bank, RBI & Nabard; however, such nomination by other entities shall be in proportion to the share held by such entities.

- Bill removes the specification that the term of a director shall not exceed two years and that he shall be eligible for re-nomination.

- However, this is only for directors other than those appointed by the central government, means two year maximum term for directors appointed by the central government & such a director shall be eligible for re-nomination provided that he does not hold office for more than four years

Problems of Regional Rural Banks

- Urban-rural geographical breakup has changed a lot since the birth of RRBs

- Many places that were villages in 70s have now become small towns

- Urbanization of rural areas > Private banks, State Cooperative Banks penetrating in rural areas

- Apart from RRBs, villagers also get services from cooperative credit societies, Microfinance institutions;

- Even commercial banks such as SBI also serve the villagers via BCA (Banking correspondence agents).

- Deposit – low; NABARD dependency high.

- Debt Waiver by government esp. before elections > Rise in NPA

- In this context, it was necessary to consolidate/merge various RRBs- to reduce their overhead expenses and make them more competitive

- Therefore in 2005, Government of India started amalgamation of RRB

Cooperative Banks

Initially set up to supplant indigenous sources of rural credit, particularly money lenders, today they mostly serve the needs of agriculture and allied activities, rural-based industries and to a lesser extent, trade and industry in urban centers. Anyonya Co-operative Bank Limited (ACBL) is the first co-operative bank in India located in the city of Vadodara in Gujarat.

- Registered under the Cooperative Societies Act, 1912 > Under the state government

- Managerial aspects of these banks – registration, management, administration, recruitment, amalgamation, liquidation, etc are controlled by the state governments.

- Regulated by the Reserve Bank of India under the Banking Regulation Act, 1949 and Banking Laws (Application to Co-operative Societies) Act, 1965

- Matters related to banking are governed by RBI directives

- Cooperative banks are owned by their customers and follow the cooperative principle of one person, one vote

- Work on the principle of “No Profit, No Loss”

- Priority Sector Lending (PSL) does not applies to cooperative banks

- Reserve ratios viz. SLR & CRR applies to them

Difference Between Commercial Banks & Cooperative Banks |

|

| Cooperative Banks | Commercial Banks |

| Co-operatives banks are co-operative organisations. | Commercial banks are joint-stock banks |

| Governed by the Co-operative Societies Act as well as Banking Regulation Act | Governed by the Banking Regulation Act |

| Subject to the rules laid down by the Registrar of Co-operative Societies | Subject to the control of the Reserve Bank of India directly |

| Borrowers are member shareholders, so they have some influence on the lending policy of the banks, on account of their voting power | Borrowers of commercial banks are only account- holders and have no voting power as such → Voting power as per shareholding |

| Have not much scope of flexibility on account of the rigidities of the bye-laws of the Co-operative Societies | Free from such rigidities |

| PSL does not applies | PSL Applies |

| Do not pursue the goal of profit maximization | Works for profit maximization |

Classification of Cooperative Banks

- Urban Cooperative Banks

- Rural Cooperative Banks

- State Cooperative Banks

- District: Central Cooperative banks

- Village: PACS (Primary agricultural cooperative society)

Primary (Urban) Co-operative Banks

- Credit societies that meet certain specified criteria can apply to RBI for a banking license to operate as urban co-operative banks.

- Are registered and governed by state governments under the respective co-operative societies acts of the concerned states.

- Since they are also covered by the provisions of the Banking Regulation Act, 1949, they come under the control of the RBI as well.

- Traditionally, the area of operation of primary (urban) co-operative banks is confined to metropolitan, urban or semi-urban centres

- Caters to the needs of small borrowers including SSIs, retail traders, small entrepreneurs, professionals and the salaried class.

Rural Cooperative Banks

- Earlier Apart from banking regulations, they were also under the supervision of the RBI

- However, following the establishment of the National Bank of Agriculture and Development (Nabard) in 1982, the supervisory function of these banks has been passed on to Nabard.

The biggest problem facing co-operative banks is the they have more than one master – in the case of UCBs, you have the RBI and the Registrar of Co-operative Societies (RCS) of the respective state and in the case of the district and state co-operative banks, They have Nabard, the RBI and the RCS.

For more updates, visit www.iasmania.com. Please share your thoughts and comments.

If you’re passionate about building a successful blogging website, check out this helpful guide at Coding Tag – How to Start a Successful Blog. It offers practical steps and expert tips to kickstart your blogging journey!

Discover more from | News and UPSC Portal

Subscribe to get the latest posts sent to your email.

2 comments

very good effort

Excellent Post