International Monetary Fund (IMF)

Bretton Woods

- Bretton Woods is a place in New Hampshire State of USA, just like BASEL is a city in Switzerland

- In 1944, President Roosevelt hosted a conference here, to rebuild the world economy, after Second World War.

- Delegates of 44 allied nations came to participate (India was represented by Sir D. Deshmukh, the first Indian Governor of RBI)

- Officially known as United Nations Monetary and Financial Conference, commonly known as Bretton Woods because of the place where it was held.

This conference resulted into creation of four important organizations viz.

- IMF (International monetary fund)

- World Bank

- GATT (General Agreement on Trade and Tarrif) – later becomes WTO in 1995

- Fixed Exchange Rate system (Discarded in 1970s)

Key Players in this meeting

- US President Franklin D Roosevelt

- UK Prime Minister Winston Churchill

- Harry Dexter White, S. Treasury

- John Maynard Keynes, UK treasury

International Monetary Fund

- HQ – Washington

- Official language – Chinese, English, French, Russian, Spanish, Arabic

- Formally created in 1945 by 29 member countries

- Stated goal was to assist in the reconstruction of world’s international payment system post World War II

- Countries contribute funds to a pool through a quota system from which countries with payment imbalances temporarily can borrow money and other resources.

Organization’s objectives as stated in the Articles of Agreement

- To promote international economic co-operation,

- To promote international trade,

- To promote employment and exchange-rate stability,

- Make financial resources available to member countries to meet balance of payments needs

Also read: United Nations Organization (UNO)

Upon initial IMF formation, its two primary functions were:

- to oversee the fixed exchange rate arrangements between countries

- to provide short-term capital to aid balance of payments

IMF’s role was fundamentally altered after the floating exchange rates post 1971

- Shifted to examining the economic policies of countries

- Researched what types of government policy would ensure economic recovery

- Its function became of surveillance of the overall macroeconomic performance of its member countries

- Now manages economic policy instead of just exchange rates + Promotes international trade

- Publishes surveys on world economy > World Economic Outlook

IMF Quota & Voting Rights

- Quotas was assigned to member countries reflecting their relative economic power & credit deposit to IMF

- Subscription was to be paid 25% in gold or currency convertible into gold (effectively the dollar, which was the only currency then, still directly gold convertible for central banks) and 75% in the member’s own currency

- Members were provided voting rights in proportion to their quota, hence member countries with higher quota have a higher say at IMF

Special Drawing Rights

- Special drawing rights (SDRs) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF)

- SDR is not a currency, instead represents a claim to currency held by IMF member countries for which they may be exchanged.

- The value of an SDR is defined by a weighted currency basket of four major currencies: the US dollar, the euro, the British pound, the Chinese Yuan and the Japanese yen

- Central bank of member countries held SDR with IMF which can be used by them to access funds from IMF in case of financial crises in their domestic market

Reverse Tansche

- A certain proportion of a member country’s quota is specified as its reserve tranche.

- The member country can access its reserve tranche funds at its discretion, and is not under an immediate obligation to repay those funds to the IMF.

- Member nation reserve tranches are typically 25% of the member’s quota.

Given its unequal voting power mechanism, IMF doesn’t always serve the interests of poor & developing countries, hence requires two set of reforms

IMF reform in quota

- IMF Executive board decides the Quota of each member based on various parameters including GDP & tariff barriers.

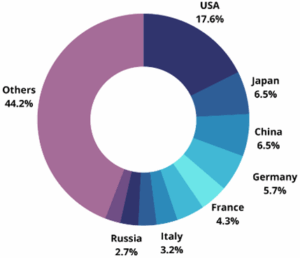

- Higher quota gives higher voting rights and borrowing permissions, But formula is designed in such way US has ~18% quota, G7 collectively own > 40% while India and Russia have barely ~2.5% each.

- BRICS, G20 and emerging market economies are against this scheme especially after Subprime crisis and declined economic strength of USA & G7

- 2010: Board decided to increases quota of developing countries albeit mainly by decreasing the quota of poor countries.

Problem : 70% votes required to implement this reform, not 70 nations, & the nations who collectively own 70% quota – USA, Germany, Japan etc. Hence quota reform is pending.

IMF reform in governance

- Currently in Executive board, 5 out 24 directors are permanently decided by five largest quota holders.

- 2010: new reforms proposed: Board composition will be reviewed every 8 years + all directors to be elected, no permanent chairs.

Problem: Requires 85% votes in favor, hence governance reform is pending as well.

For more updates, explore the IR & Security Category. Feel free to share your thoughts and comments

If you’re passionate about building a successful blogging website, check out this helpful guide at Coding Tag – How to Start a Successful Blog. It offers practical steps and expert tips to kickstart your blogging journey!

3 comments

Home Forums

Small correction needed. include chinese yuan in the SDR list. Recently it has been added…

Added!