Foreign Trade Policy 2015 – 2020

Union Minister of Commerce & Industry unveiled Foreign Trade Policy (FTP) 2015-2020. It aims to support both manufacturing & services sectors, with a special emphasis ease of doing business.

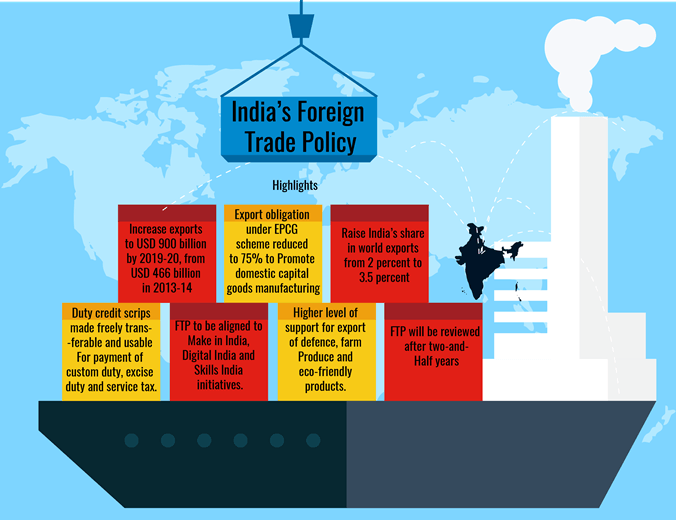

Key Highlights of the FTP 2015-20

- Replaced all existing focus product and focus market schemes for goods with a single Merchandise Export from India Scheme. Under the scheme, incentives will be given for export of specific goods to specific markets.

- For services, all schemes have been replaced by a Services Export from India Scheme, with a greater thrust on notified services.

- Duty credit scrips issued under MEIS and SEIS and the goods imported against these scrips are fully transferable and usable for payment of custom duty, excise duty and service tax.

- Extended benefits of both incentive schemes for export of goods & services to units in SEZ

- Export obligation under EPCG scheme reduced to 75% to Promote domestic capital goods mfg.

Targets of FTP 2015-20

- Increase exports to USD 900 billion by 2019-20, from USD 466 billion in 2013-14

- Raise India’s share in world exports from 2 % to 3.5 %

- FTP to be aligned to Make in India, Digital India and Skills India initiatives, with paperless working in 24×7 Environment.

- Unlike annual reviews, FTP will be reviewed after two-and-Half years, except for exigencies.

Export Promotion Capital Goods (EPCG) Scheme

- As per the Foreign Trade Policy 2009-14 amended later time to time in annual supplements, EPCG Authorization holder is permitted to import capital goods at 0% or 3% Customs duty.

- Under the 0% duty, EPCG Authorization holder is required to undertake export obligation equivalent to 6 times of the duty saved amount on the capital goods imported within a period of 6 years.

- Under the 3% duty EPCG scheme, the Authorization holder has to fulfill export obligation equivalent to 8 times of the duty saved amount on the capital goods imported in 8 years.

- Goods imported cannot be transferred or sold at DTA till the fulfillment of export obligation.